Tax Rate Victoria Australia . This page includes current and historical rates of taxes, duties and. The phase out rate from 1 july 2024 is 45%. That means your income is taxed in brackets and. We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other. Employers and groups with total annual. The bottom tax rate decreases from 19% to 16%; All income received by individuals is taxed at progressive tax rates in australia. What your take home salary will be when tax. The 32.5% tax rate decreases to 30%; Medicare levy surcharge income, thresholds and rates. The financial year for tax purposes for. From 1 july 2025 and each subsequent financial year it is 50%. The threshold above which the 37% tax rate applies increases from $120,000 to $135,000; How much australian income tax you should be paying. Stay informed about victoria's taxation legislation, duties, levies and grants.

from www.sro.vic.gov.au

The threshold above which the 37% tax rate applies increases from $120,000 to $135,000; The phase out rate from 1 july 2024 is 45%. The bottom tax rate decreases from 19% to 16%; The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. What your take home salary will be when tax. That means your income is taxed in brackets and. How much australian income tax you should be paying. From 1 july 2025 and each subsequent financial year it is 50%. Employers and groups with total annual. The financial year for tax purposes for.

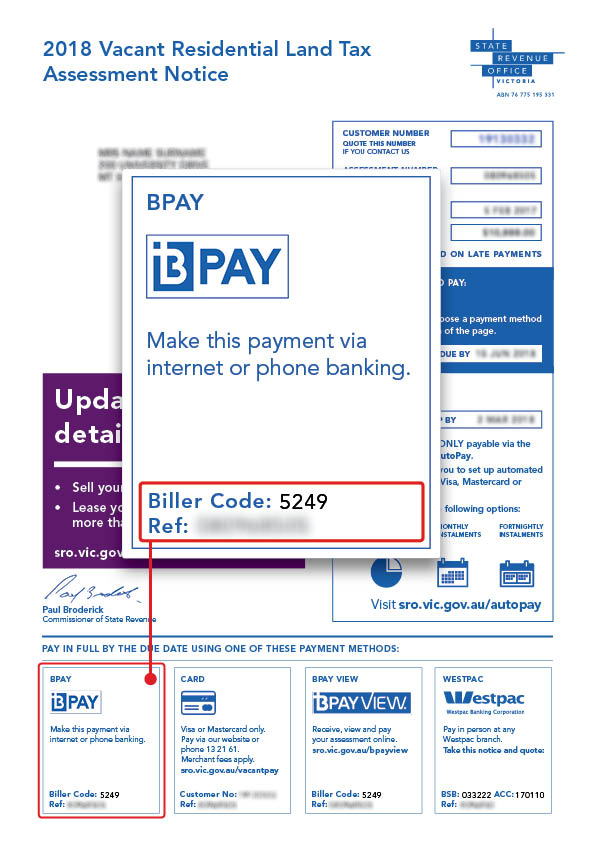

Pay your vacant residential land tax assessment State Revenue Office

Tax Rate Victoria Australia From 1 july 2025 and each subsequent financial year it is 50%. This page includes current and historical rates of taxes, duties and. Employers and groups with total annual. The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. That means your income is taxed in brackets and. What your take home salary will be when tax. We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other. The 32.5% tax rate decreases to 30%; The financial year for tax purposes for. From 1 july 2025 and each subsequent financial year it is 50%. Use the simple tax calculator to work out just the tax you owe on. How much australian income tax you should be paying. All income received by individuals is taxed at progressive tax rates in australia. Stay informed about victoria's taxation legislation, duties, levies and grants. The threshold above which the 37% tax rate applies increases from $120,000 to $135,000; Medicare levy surcharge income, thresholds and rates.

From www.brisbanetimes.com.au

Video Australia's unemployment rate rises to 4.2 per cent in July Tax Rate Victoria Australia The phase out rate from 1 july 2024 is 45%. What your take home salary will be when tax. All income received by individuals is taxed at progressive tax rates in australia. Stay informed about victoria's taxation legislation, duties, levies and grants. That means your income is taxed in brackets and. From 1 july 2025 and each subsequent financial year. Tax Rate Victoria Australia.

From www.afr.com

Dan Andrews warned not to tax his way out of Victoria’s budget hole Tax Rate Victoria Australia The 32.5% tax rate decreases to 30%; We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other. The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. The bottom tax rate decreases from 19% to 16%; Employers and. Tax Rate Victoria Australia.

From whichrealestateagent.com.au

Australian Property Market Forecast 2023 Is It All Bad News? [Updated] Tax Rate Victoria Australia What your take home salary will be when tax. The financial year for tax purposes for. Medicare levy surcharge income, thresholds and rates. That means your income is taxed in brackets and. The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. The 32.5% tax rate decreases to 30%; All income received by. Tax Rate Victoria Australia.

From www.bentleys.com.au

The rise and rise of land tax in Australia Bentleys Tax Rate Victoria Australia Stay informed about victoria's taxation legislation, duties, levies and grants. How much australian income tax you should be paying. Medicare levy surcharge income, thresholds and rates. All income received by individuals is taxed at progressive tax rates in australia. The financial year for tax purposes for. The phase out rate from 1 july 2024 is 45%. Use the simple tax. Tax Rate Victoria Australia.

From www.catebakos.com.au

Land Tax Cate Bakos Property / Independent buyers advocate, qualified Tax Rate Victoria Australia Use the simple tax calculator to work out just the tax you owe on. The financial year for tax purposes for. Stay informed about victoria's taxation legislation, duties, levies and grants. From 1 july 2025 and each subsequent financial year it is 50%. All income received by individuals is taxed at progressive tax rates in australia. The phase out rate. Tax Rate Victoria Australia.

From www.sro.vic.gov.au

Pay your vacant residential land tax assessment State Revenue Office Tax Rate Victoria Australia The financial year for tax purposes for. From 1 july 2025 and each subsequent financial year it is 50%. The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. That means your income is taxed in brackets and. Use the simple tax calculator to work out just the tax you owe on. The. Tax Rate Victoria Australia.

From www.catebakos.com.au

Land Tax Cate Bakos Property / Independent buyers advocate, qualified Tax Rate Victoria Australia The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other. The bottom tax rate decreases from 19% to 16%; Medicare levy surcharge income, thresholds and rates. Employers and. Tax Rate Victoria Australia.

From www.sro.vic.gov.au

Pay your vacant residential land tax assessment State Revenue Office Tax Rate Victoria Australia The threshold above which the 37% tax rate applies increases from $120,000 to $135,000; Employers and groups with total annual. The bottom tax rate decreases from 19% to 16%; The financial year for tax purposes for. All income received by individuals is taxed at progressive tax rates in australia. That means your income is taxed in brackets and. The phase. Tax Rate Victoria Australia.

From www.mccullough.com.au

New Queensland land tax rules McCullough Robertson Lawyers Tax Rate Victoria Australia We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other. The bottom tax rate decreases from 19% to 16%; This page includes current and historical rates of taxes, duties and. Stay informed about victoria's taxation legislation, duties, levies and grants. How much australian income tax. Tax Rate Victoria Australia.

From www.youtube.com

Victoria Sentenced to a Decade of Taxes YouTube Tax Rate Victoria Australia This page includes current and historical rates of taxes, duties and. The phase out rate from 1 july 2024 is 45%. The 32.5% tax rate decreases to 30%; The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. That means your income is taxed in brackets and. How much australian income tax you. Tax Rate Victoria Australia.

From cordiysapphira.pages.dev

Tax Calculator 2024 Australia Nancy Valerie Tax Rate Victoria Australia That means your income is taxed in brackets and. The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. What your take home salary will be when tax. From 1 july 2025 and each subsequent financial year it is 50%. The phase out rate from 1 july 2024 is 45%. The threshold above. Tax Rate Victoria Australia.

From vivianawnerta.pages.dev

New Tax Brackets 2024 Australia Vilma Jerrylee Tax Rate Victoria Australia The financial year for tax purposes for. What your take home salary will be when tax. The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. Use the simple tax calculator to work out just the tax you owe on. How much australian income tax you should be paying. All income received by. Tax Rate Victoria Australia.

From www.ntnews.com.au

New state government taxes hurting Victoria’s property sector NT News Tax Rate Victoria Australia The 32.5% tax rate decreases to 30%; What your take home salary will be when tax. The bottom tax rate decreases from 19% to 16%; That means your income is taxed in brackets and. Use the simple tax calculator to work out just the tax you owe on. This page includes current and historical rates of taxes, duties and. The. Tax Rate Victoria Australia.

From www.theage.com.au

Victoria budget 2023 Investment property owners hit with tax slug Tax Rate Victoria Australia The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. Employers and groups with total annual. Stay informed about victoria's taxation legislation, duties, levies and grants. This page includes current and historical rates of taxes, duties and. How much australian income tax you should be paying. From 1 july 2025 and each subsequent. Tax Rate Victoria Australia.

From www.ebay.com

VICTORIA 6d TAX INSTALMENT 1937 NO GUM. eBay Tax Rate Victoria Australia This page includes current and historical rates of taxes, duties and. The phase out rate from 1 july 2024 is 45%. Employers and groups with total annual. That means your income is taxed in brackets and. How much australian income tax you should be paying. The threshold above which the 37% tax rate applies increases from $120,000 to $135,000; The. Tax Rate Victoria Australia.

From kara-lynnwmamie.pages.dev

Tax Brackets 2024 Australia Calculator Elnora Frannie Tax Rate Victoria Australia The threshold above which the 37% tax rate applies increases from $120,000 to $135,000; Stay informed about victoria's taxation legislation, duties, levies and grants. Medicare levy surcharge income, thresholds and rates. The bottom tax rate decreases from 19% to 16%; The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. The phase out. Tax Rate Victoria Australia.

From www.pitcher.com.au

Victorian State Budget 202324 Payroll tax Pitcher Partners Tax Rate Victoria Australia Employers and groups with total annual. The financial year for tax purposes for. The 2022 financial year in australia starts on 1 july 2021 and ends on 30 june 2022. The threshold above which the 37% tax rate applies increases from $120,000 to $135,000; Medicare levy surcharge income, thresholds and rates. That means your income is taxed in brackets and.. Tax Rate Victoria Australia.

From www.yourinvestmentpropertymag.com.au

The QLD land tax grab that could hurt investors YIP Tax Rate Victoria Australia That means your income is taxed in brackets and. The phase out rate from 1 july 2024 is 45%. The bottom tax rate decreases from 19% to 16%; This page includes current and historical rates of taxes, duties and. The financial year for tax purposes for. All income received by individuals is taxed at progressive tax rates in australia. The. Tax Rate Victoria Australia.